Bitcoin bull run comeback? Whale exchange inflow metric nears 5-year high

Recent data indicates that Bitcoin (BTC) is poised for a potential bull run continuation, as whale inflows to exchanges have plateaued this month. On-chain analytics platform CryptoQuant reports that the 30-day simple moving average of the Whale Exchange Ratio—measuring the top 10 inflows to exchanges relative to all inflows—stood at 0.46 on February 12, nearing multi-year highs. This trend suggests that a downturn in whale deposits on spot exchanges often precedes a bullish Bitcoin rally.

Additionally, Bitcoin miners have shifted back to accumulation in February, following a six-month period of consistent outflows. This change coincides with a new "capitulation" phase, which historically marks local market bottoms.

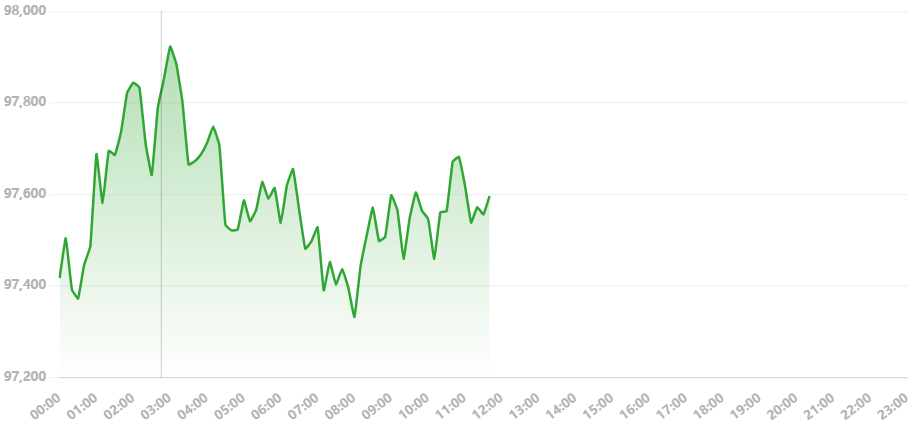

As of now, Bitcoin is trading at $97,662, reflecting a 0.81% increase from the previous close.

Recent data indicates that Bitcoin (BTC) is poised for a potential bull run continuation, as whale inflows to exchanges have plateaued this month. On-chain analytics platform CryptoQuant reports that the 30-day simple moving average of the Whale Exchange Ratio—measuring the top 10 inflows to exchanges relative to all inflows—stood at 0.46 on February 12, nearing multi-year highs. This trend suggests that a downturn in whale deposits on spot exchanges often precedes a bullish Bitcoin rally.

Additionally, Bitcoin miners have shifted back to accumulation in February, following a six-month period of consistent outflows. This change coincides with a new "capitulation" phase, which historically marks local market bottoms.

As of now, Bitcoin is trading at $97,662, reflecting a 0.81% increase from the previous close.

Bitcoin (BTC)